Tesla’s Stock Price Journey and Explosive Growth

Visualization:

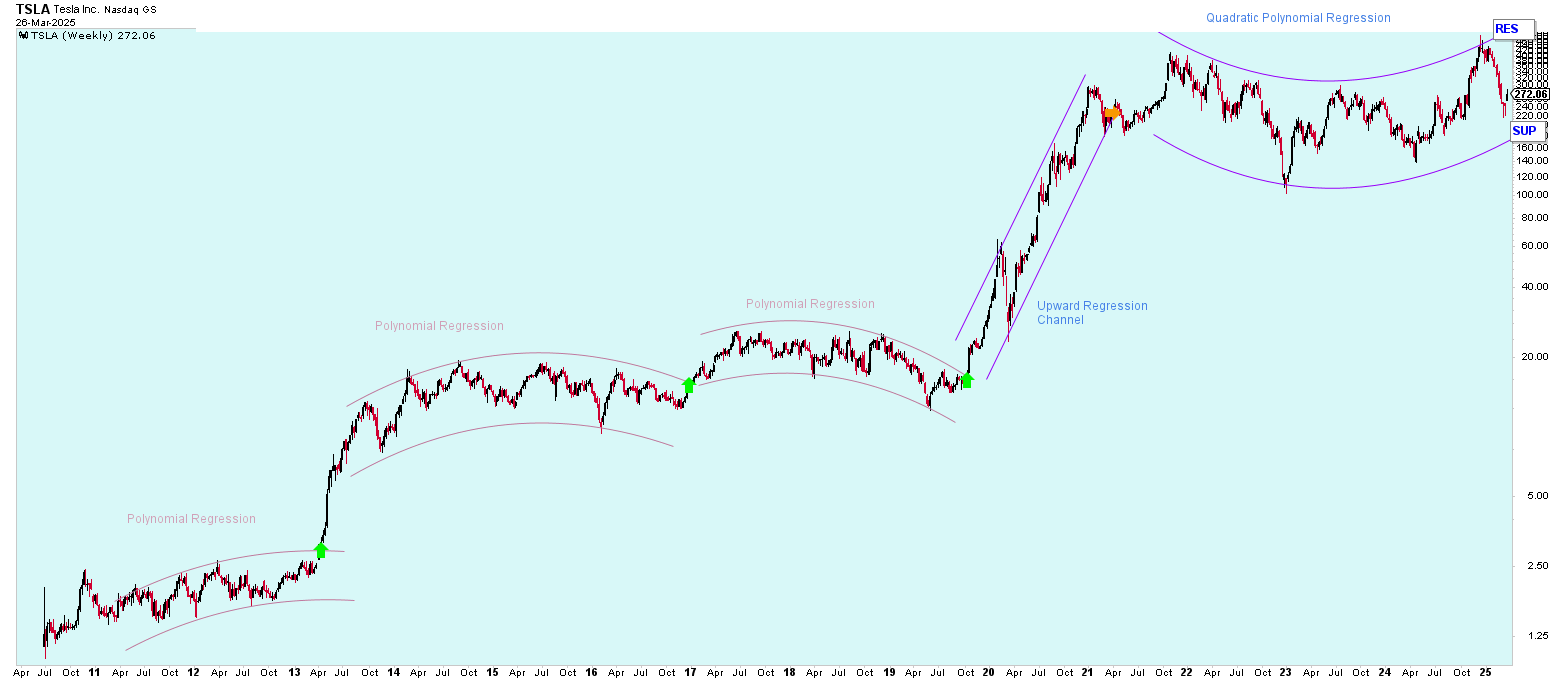

- Clearly annotated Tesla stock

chart highlighting key regression shapes:

- Initial 3-year consolidation and April 2013 breakout.

- Higher-degree polynomial regression channel (2013–2017).

- Downward-sloping polynomial regression (2017–2020).

- Explosive exponential breakout from October 2020.

- Current upward quadratic regression (2021 onwards).

Analytical Questions for Students:

1. Initial Range-Bound Phase & April 2013 Breakout:

- Why was Tesla’s stock price range-bound in its early years (prior to April 2013)?

- Identify fundamental or strategic reasons behind the 3X price explosion within 4 months after the April 2013 breakout.

2. Higher-Degree Polynomial Regression & 2017 Breakout:

- After rapid gains, why did Tesla settle into a higher-degree polynomial regression range from 2013–2017?

- What factors caused the breakout in 2017, resulting in just 75% increase?

3. Downward Polynomial Regression (2017–2020):

- What factors contributed to Tesla’s 3-year consolidation in a downward-sloping polynomial regression channel?

- Were these due to fundamental concerns, market perception, or external conditions?

4. Explosive Exponential Breakout (October 2020):

- Why did Tesla’s stock price breakout explosively in October 2020, achieving 19X returns in less than 18 months?

- Analyze the fundamental changes, market sentiment, technological breakthroughs, or external economic factors involved.

5. Sustaining Gains & Quadratic Regression (2021 onwards):

- Despite massive gains, why has Tesla’s stock consistently sustained higher prices without significant pullbacks?

- What structural or strategic reasons support this prolonged price stability?

6. Future Outlook: Quadratic to Exponential?

- Do you believe Tesla’s current quadratic regression trend could transform into another exponential growth curve?

- Discuss the key innovations, market conditions, or challenges Tesla faces in transitioning into another growth phase.

Research and Resources:

- Tesla Investor Relations

- Tesla SEC Filings

- Macrotrends – Tesla Historical Stock Prices

- Tesla’s Annual Reports and Earnings Calls

- Investopedia – Tesla Company Analysis

Objective:

This case study enables students to connect regression-based stock-price movements with Tesla’s underlying business dynamics, market sentiment, technological innovations, and macroeconomic factors. Through detailed analysis, students develop the ability to critically assess explosive growth trends and sustainability in innovative and rapidly evolving industries.