Apple's 40-Year Stock Price Journey

Visualization:

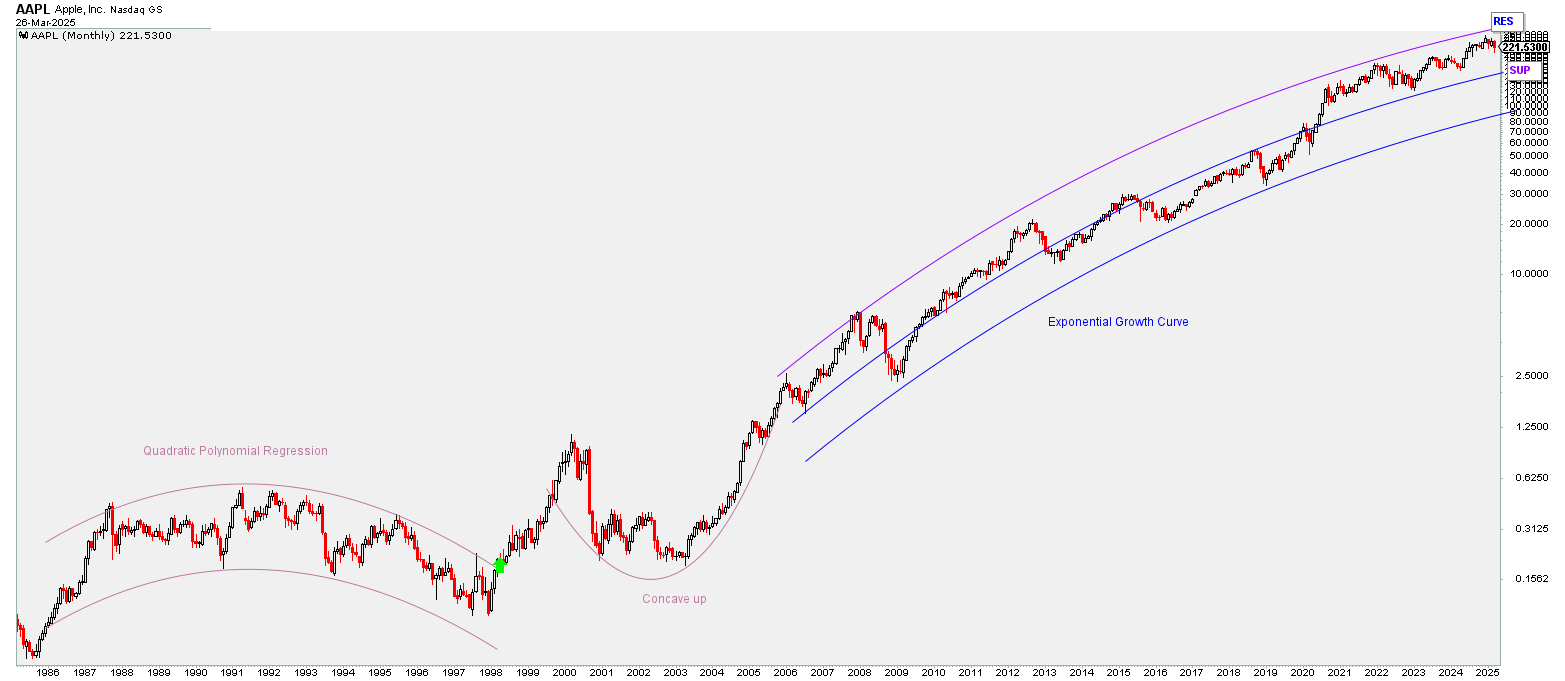

- Include Apple's 40-year stock

price chart clearly annotated with regression-based trends:

- 1985–1998: Slight downward sloping quadratic regression.

- 1998 Breakout and subsequent Dotcom crash.

- 2005–2025: Smooth, exponential upward growth curve.

Analytical Questions for Students:

1. Long Consolidation (1985–1998)

- Why did Apple’s stock remain in a slight downward-sloping quadratic regression for almost 13 years?

- What were Apple's business challenges or limitations during this period?

- Discuss market perception and fundamental issues faced by Apple.

2. Breakout in 1998: Structural Story or Dotcom Bubble?

- What factors triggered Apple's breakout from this long consolidation?

- Was this breakout due to fundamental improvements (structural changes) or market speculation (Dotcom bubble)? Provide evidence to support your analysis.

3. Dotcom Crash and Recovery (2000–2005)

- Apple’s stock fell nearly 80% during the Dotcom crash. Why was the fall so severe?

- Why did it take Apple 5 years to fully recover its losses? What fundamentals supported this gradual recovery?

4. Exponential Growth Curve (2005–2025)

- Why has Apple's stock price followed such a smooth exponential growth curve for nearly 20 years?

- What strategic decisions, innovations, or market conditions contributed to sustained exponential growth?

5. Game-Changing Factors for Apple's Long-Term Success:

- Identify and discuss key game-changing events or strategies Apple employed since 2005 (consider product launches, innovation, ecosystem development, branding, leadership, and financial strategy).

- How did these factors contribute to Apple's stable and prolonged exponential growth?

Research and Resources:

- Apple Investor Relations

- SEC Filings – Apple

- Macrotrends – Historical Apple Stock Prices

- FRED Economic Data – interest rates, GDP, consumer data

- Investopedia – Apple’s History and Strategic Analysis

Objective:

By analyzing Apple's long-term stock performance through regression shapes, students will gain insights into how fundamental company developments, market cycles, and strategic innovations impact stock valuations and trends. This analytical approach will help them develop critical thinking and robust investment decision-making skills.